金融:2022年CFA三级【G】 百度网盘(69.27G)

课程文件目录:金融:2022年CFA三级【G】[69.27G]

【1】知识精讲(5-11月) [53.77G]

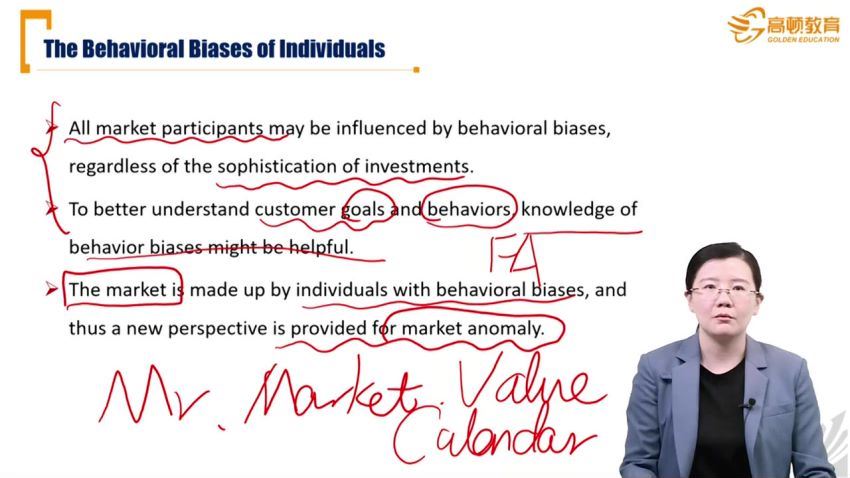

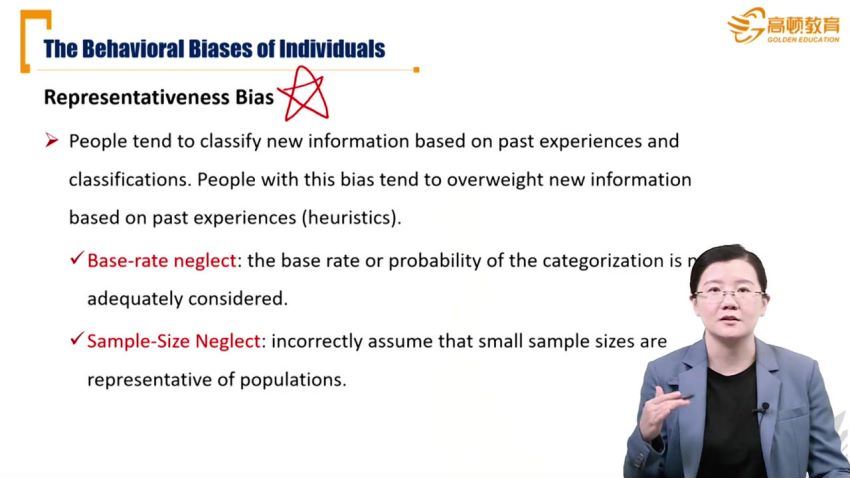

01-behavioral finance [2.56G]

claire [1.40G]

01-introduction.mp4 [128.21M]

02-introdution of the behavioral biases.mp4 [71.99M]

03-cognitive errors(1).mp4 [174.90M]

04-cognitive errors(2).mp4 [150.57M]

05-cognitive errors(3).mp4 [115.40M]

06-cognitive errors(4).mp4 [68.50M]

07-cognitive errors(5).mp4 [115.47M]

08-emotional biases(1).mp4 [133.31M]

09-emotional biases(2).mp4 [88.79M]

10-emotional biases(3).mp4 [73.67M]

11-conclusion.mp4 [49.43M]

12-behavioral finance&investment processes(1).mp4 [100.01M]

13-behavioral finance&investment processes(2).mp4 [47.53M]

14-behavioral finance&investment processes(3).mp4 [78.21M]

l3-精讲行为金融-claire.pdf [38.24M]

wen [1.16G]

01-introduction.mp4 [21.85M]

02-understanding portfolio management.mp4 [24.17M]

03-understanding behavioral finance.mp4 [48.05M]

04-cognitive errors [1].mp4 [88.21M]

05-try it .mp4 [76.87M]

06-cognitive errors [2] .mp4 [90.90M]

07-emotional bias .mp4 [146.69M]

08-try it again.mp4 [59.24M]

09-summary.mp4 [70.74M]

10-practice makes perfect [1].mp4 [72.03M]

11-practice makes perfect [2].mp4 [54.71M]

12-two-way and five-way model.mp4 [46.10M]

13-four-way model.mp4 [45.74M]

14-client relations, portfolios & analyst forecasts .mp4 [82.89M]

15-management, committee & market anomalies.mp4 [58.88M]

16-summary.mp4 [20.69M]

17-practice[1] .mp4 [60.84M]

18-practice[2] .mp4 [29.61M]

19-practice[3] .mp4 [38.33M]

20-last but not least.mp4 [31.63M]

l3-精讲行为金融-wen.pdf [23.84M]

02-economic [4.96G]

chen [3.46G]

01-cfa l3 economic introduction.mp4 [30.73M]

02-introduction.mp4 [16.63M]

03-framework and challenges for developing cme.mp4 [192.98M]

04-analysis of economic growth.mp4 [135.48M]

05-approaches to economic forecasting.mp4 [74.64M]

06-business cycle analysis(1).mp4 [173.62M]

07-business cycle analysis(2).mp4 [92.74M]

08-analysis of monetary and fiscal policy.mp4 [195.14M]

09-international interactions.mp4 [171.51M]

10-summary of whole reading.mp4 [46.09M]

11-introduction for the whole reading.mp4 [27.67M]

12-overview and adjustment to a global portfolio.mp4 [195.44M]

13-forecasting fixed-income return.mp4 [344.44M]

14-forecasting equity returns :gk model.mp4 [321.87M]

15-forecasting equity returns :gk model.mp4 [337.15M]

16-forecasting real estate returns.mp4 [321.32M]

17-forecasting exchange rate.mp4 [175.63M]

18-estimation of variance-covariancce structures(1).mp4 [282.70M]

19-estimation of variance-covariancce structures(2).mp4 [208.51M]

20-summary for the whole reading.mp4 [88.84M]

21-summary of cfa l3 economic.mp4 [69.51M]

l3-精讲经济-chen.pdf [40.10M]

veronica [1.50G]

01-introduction.mp4 [30.45M]

02-framework and challenges(1).mp4 [109.29M]

03-framework and challenges(2).mp4 [113.32M]

04-summary 1.mp4 [23.84M]

05-economic and market analysis(1).mp4 [79.16M]

06-economic and market analysis(2).mp4 [71.17M]

07-economic and market analysis(3).mp4 [95.92M]

08-economic and market analysis(4).mp4 [73.20M]

09-economic and market analysis(5).mp4 [117.62M]

10-economic and market analysis(6).mp4 [53.85M]

11-economic and market analysis(7).mp4 [71.05M]

12-international interactions.mp4 [55.93M]

13-summary 2.mp4 [28.14M]

14-overview of tools and approaches.mp4 [28.78M]

15-forecasting the fixed-income returns.mp4 [68.39M]

16-forecasting the equity returns(1).mp4 [58.69M]

17-forecasting the equity returns(2).mp4 [69.10M]

18-forecasting real estate returns.mp4 [88.65M]

19-forecasting exchange rates.mp4 [88.15M]

20-forecasting volatility.mp4 [95.53M]

21-adjusting a global portfolio.mp4 [57.42M]

22-summary 3.mp4 [45.67M]

l3-精讲经济-veronica.pdf [14.32M]

03-资产配置 [4.61G]

chen [2.83G]

01-brief introduction for asset allocation.mp4 [41.04M]

02-overview of asset allocation.mp4 [21.63M]

03-investment governance.mp4 [71.22M]

04-a quick glance of asset allocation.mp4 [164.06M]

05-three categories.mp4 [243.03M]

06-two categories.mp4 [140.08M]

07-implementation of asset allocation.mp4 [189.37M]

08-rebalance asset allocation.mp4 [282.34M]

09-summary for the whole reading.mp4 [34.12M]

10-brief introduction.mp4 [36.34M]

11-introduction of mean-variance optimization.mp4 [291.77M]

12-criticisms of mean-variance optimization.mp4 [47.41M]

13-other issues of mean-variance optimization.mp4 [80.47M]

14-other models.mp4 [171.40M]

15-introduction of liability-relative allocation.mp4 [52.15M]

16-approaches to liability-relative asset allocation.mp4 [74.65M]

17-goals-based allocation.mp4 [81.42M]

18-other asset allocation approaches.mp4 [165.36M]

19-summary for the whole reading.mp4 [65.68M]

20-brief introduction.mp4 [25.22M]

21-constraints in allocation.mp4 [142.18M]

22-tax considerations in asset allocation.mp4 [79.90M]

23-revisions and short-term shift.mp4 [105.49M]

24-behavioral biases in asset allocation.mp4 [161.43M]

25-summary for the whole reading.mp4 [3.69M]

26-review of the whole session.mp4 [74.72M]

l3-精讲资产配置-chen.pdf [49.73M]

feng [1.78G]

01-brief introduction.mp4 [30.46M]

02-investment governance.mp4 [75.16M]

03-strategic asset allocation.mp4 [79.93M]

04-approaches of asset allocation(1).mp4 [158.28M]

05-approaches of asset allocation(2).mp4 [137.71M]

06-implementation of asset allocation(1).mp4 [109.87M]

07-implementation of asset allocation(2).mp4 [141.15M]

08-summary for this reading.mp4 [60.05M]

09-asset-only allocation(1).mp4 [170.05M]

10-asset-only allocation(2).mp4 [203.81M]

11-liability-relative allocation.mp4 [151.43M]

12-goals-based allocation and heuristic allocation approaches.mp4 [78.54M]

13-summary for this reading.mp4 [66.01M]

14-constraints in asset allocation(1).mp4 [72.24M]

15-constraints in asset allocation(2).mp4 [96.82M]

16-asset allocation with real-world constraints.mp4 [117.08M]

17-summary for this reading.mp4 [47.09M]

l3-精讲资产配置-feng.pdf [29.53M]

04-衍生 [7.72G]

chen [5.20G]

01-introduction.mp4 [50.62M]

02-brief introduction.mp4 [43.12M]

03-introduction and review from l1 & l2.mp4 [208.65M]

04-position equivalencies.mp4 [195.21M]

05-covered call :characteristics(1).mp4 [175.85M]

06-covered call :characteristics(2).mp4 [124.55M]

07-covered call :investment objectives.mp4 [212.43M]

08-protective put.mp4 [87.86M]

09-bull spread and bear spread.mp4 [297.11M]

10-butterfly spresd.mp4 [110.34M]

11-calendar spread.mp4 [161.93M]

12-straddle.mp4 [93.32M]

13-collars.mp4 [158.37M]

14-portfolio’s greeks.mp4 [77.84M]

15-risk-reduction strategies.mp4 [98.94M]

16-risk-reduction strategies.mp4 [70.88M]

17-implied volatility and volatility skew.mp4 [178.87M]

18-investment objectives and strategy selection.mp4 [114.00M]

19-summary for the whole reading.mp4 [45.96M]

20-brief introduction.mp4 [12.18M]

21-interest rate swaps (1).mp4 [107.34M]

22-interest rate swaps (2).mp4 [113.82M]

23-interest rate forwards and futures.mp4 [108.89M]

24-fixed-income futures:delivery.mp4 [211.11M]

25-fixed-income futures:hedging(1).mp4 [119.60M]

26-fixed-income futures:hedging(2).mp4 [89.55M]

27-equity swaps.mp4 [75.83M]

28-equity forwards and futures.mp4 [168.73M]

29-asset allocation using futures.mp4 [138.45M]

30-asset allocation using swaps.mp4 [93.48M]

31-infer market expectations.mp4 [142.61M]

32-managing currency exposure.mp4 [146.14M]

33-volatility futures and options.mp4 [71.93M]

34-variance swaps.mp4 [98.88M]

35-summary for the whole reading.mp4 [34.51M]

36-brief introduction.mp4 [22.09M]

37-exchange rate quotation.mp4 [82.78M]

38-basic trading tools.mp4 [123.01M]

39-effects of currency movement.mp4 [109.79M]

40-some basic concepts.mp4 [48.33M]

41-different strategies.mp4 [115.49M]

42-tactical decisions.mp4 [161.02M]

43-tools for currency management.mp4 [179.28M]

44-hedging multiple currencies & emerging market currency management.mp4 [87.40M]

45-summary for the whole reading.mp4 [16.35M]

46-reviews and chen’s final .mp4 [87.82M]

l3-精讲衍生-chen.pdf [57.61M]

feng [2.51G]

01-brief introduction.mp4 [34.47M]

02-option strategies.mp4 [157.01M]

03-covered call and protective put(1).mp4 [107.12M]

04-covered call and protective put(2).mp4 [92.52M]

05-spread and combination strategies(1).mp4 [75.64M]

06-spread and combination strategies(2).mp4 [110.70M]

07-volatility skew and smile.mp4 [121.02M]

08-option strategy selection.mp4 [72.00M]

09-mindmap of reading 1.mp4 [25.95M]

10-swaps,forwards,and futures strategies.mp4 [49.96M]

11-portfolio’s risk and return modification(1).mp4 [91.38M]

12-portfolio’s risk and return modification(2).mp4 [110.26M]

13-portfolio’s risk and return modification currency risk.mp4 [152.89M]

14-portfolio risk and return modification: equity risk.mp4 [107.26M]

15-derivatives on volatility.mp4 [113.74M]

16-asset allocation & rebalancing.mp4 [101.66M]

17-inferring market expectations.mp4 [86.12M]

18-mindmap of reading 2.mp4 [106.48M]

19-currency management:an introduction.mp4 [57.69M]

20-basics of currency management.mp4 [217.97M]

21-currency management decisions(1).mp4 [157.67M]

22-currency management decisions(2).mp4 [224.98M]

23-currency management decisions(3).mp4 [73.59M]

24-mindmap of reading 3.mp4 [82.86M]

l3-精讲衍生-feng.pdf [40.55M]

05-权益组合管理 [5.85G]

chen [3.18G]

01-introduction.mp4 [28.15M]

02-introduction to equity portfolio management.mp4 [11.71M]

03-equity investment universe.mp4 [157.14M]

04-income and costs in equity investment.mp4 [172.22M]

05-other topics.mp4 [62.08M]

06-summary for whole reading.mp4 [12.55M]

07-introduction passive equity investment.mp4 [22.43M]

08-choose a passive benchmark.mp4 [123.78M]

09-index construction methodologies.mp4 [154.47M]

10-factor-based strategies.mp4 [128.89M]

11-approaches to gain exposures to the index.mp4 [103.91M]

12-passive portfolio construction techniques.mp4 [62.65M]

13-tracking error management.mp4 [55.32M]

14-attribute the sources of return and risk.mp4 [98.41M]

15-summary for the whole reading.mp4 [21.81M]

16-introduction active equity investing :strategies.mp4 [22.56M]

17-two broad approaches of active investment strategies.mp4 [89.99M]

18-types of active management strategies.mp4 [139.76M]

19-factor-based strategies:hedged portfolio approach.mp4 [143.18M]

20-factor-based strategies:factor timing.mp4 [136.96M]

21-activist strategies and other strategies.mp4 [79.64M]

22-develop a fundamental active investment.mp4 [119.28M]

23-develop a quantitative investment.mp4 [111.48M]

24-style classification of active strategies.mp4 [92.63M]

25-summary the whole reading.mp4 [20.78M]

26-active return.mp4 [125.40M]

27-definition of active share & active risk.mp4 [104.42M]

28-relationship between active share & active risk.mp4 [139.55M]

29-absolute and relative measures of risk.mp4 [202.36M]

30-determining the appropriate level of risk.mp4 [86.47M]

31-approach to portfolio construction.mp4 [63.65M]

32-implicit cost-related considerations in portfolio construction.mp4 [108.86M]

33-certain specialized equity strategies.mp4 [140.09M]

34-certain specialized equity strategies.mp4 [20.11M]

35-review and chen’s final tips.mp4 [31.23M]

l3-精讲权益-chen.pdf [61.48M]

lei [2.67G]

01-brief introduction.mp4 [65.52M]

02-brief introduction for this reading.mp4 [5.64M]

03-introduction to equity portfolio management(1):part ⅰ.mp4 [120.60M]

04-introduction to equity portfolio management(1):part ⅱ.mp4 [64.17M]

05-introduction to equity portfolio management(2):part ⅰ.mp4 [117.33M]

06-introduction to equity portfolio management(2):part ⅱ.mp4 [72.62M]

07-covered call & cash secured put.mp4 [46.01M]

08-summary for this reading.mp4 [38.83M]

09-brief introduction for this reading.mp4 [15.17M]

10-passive equity investing(1):part ⅰ.mp4 [88.55M]

11-passive equity investing(1):part ⅱ.mp4 [111.83M]

12-passive equity investing(1):part ⅲ.mp4 [75.59M]

13-passive equity investing(2) part ⅰ.mp4 [49.01M]

14-passive equity investing(2) part ⅱ.mp4 [86.17M]

15-passive equity investing(3).mp4 [39.79M]

16-passive equity investing(4).mp4 [106.46M]

17-summary for this reading.mp4 [59.95M]

18-brief introduction for this reading.mp4 [13.21M]

19-active equity investing:strategies(1).mp4 [86.11M]

20-active equity investing:strategies(2):part ⅰ.mp4 [91.89M]

21-active equity investing:strategies(2):part ⅱ.mp4 [155.29M]

22-supplementary task 1.mp4 [41.37M]

23-active equity investing:strategies(2):part ⅲ.mp4 [103.91M]

24-supplementary task 2.mp4 [70.65M]

25-active equity investing:strategies(3).mp4 [74.58M]

26-supplementary task 3.mp4 [112.45M]

27-active equity investing:strategies(4).mp4 [55.22M]

28-summary for this reading.mp4 [61.68M]

29-brief introduction for this reading.mp4 [15.74M]

30-active equity investing:portfolio construction(1) :part ⅰ.mp4 [105.95M]

31-active equity investing:portfolio construction(1):part ⅱ.mp4 [67.29M]

32-active equity investing:portfolio construction(1) :part ⅲ.mp4 [98.21M]

33-active equity investing:portfolio construction(2):part ⅰ.mp4 [90.74M]

34-active equity investing:portfolio construction(2):part ⅱ.mp4 [70.68M]

35-active equity investing:portfolio construction(3):part ⅰ.mp4 [53.18M]

36-active equity investing:portfolio construction(3):part ⅱ.mp4 [105.47M]

37-summary for this reading.mp4 [71.04M]

l3-精讲权益-lei.pdf [28.58M]

06-交易、业绩评估与经理选择 [4.58G]

luke [2.99G]

01-brief introduction.mp4 [65.12M]

02-motivations to trade.mp4 [122.34M]

03-strategies and selection.mp4 [239.36M]

04-strategy implement(1).mp4 [99.05M]

05-strategy implement(2).mp4 [198.10M]

06-strategy implement(3).mp4 [56.33M]

07-trade evaluation(1).mp4 [121.76M]

08-trade evaluation(2).mp4 [76.35M]

09-trade governance.mp4 [60.25M]

10-summary.mp4 [71.14M]

11-introduction to performance evaluation.mp4 [58.58M]

12-equity return attribution(1).mp4 [174.89M]

13-equity return attribution(2).mp4 [97.13M]

14-fixed income return attribution(1).mp4 [154.50M]

15-fixed income return attribution(2).mp4 [59.23M]

16-risk attribution and other types of attribution.mp4 [168.23M]

17-types of benchmarks.mp4 [78.28M]

18-choosing the correct benchmark(1).mp4 [99.70M]

19-choosing the correct benchmark(2).mp4 [156.42M]

20-performance appraisal.mp4 [237.74M]

21-summary.mp4 [104.69M]

22-framework for manager selection.mp4 [217.33M]

23-investment due diligence.mp4 [114.65M]

24-operational due diligence.mp4 [160.72M]

25-summary.mp4 [28.87M]

l3-精讲交易-luke.pdf [42.84M]

wen [1.58G]

01-brief introduction.mp4 [13.73M]

02-motivation to trade.mp4 [64.75M]

03-strategies and selection.mp4 [86.71M]

04-strategy selection example.mp4 [28.41M]

05-strategy implementation.mp4 [98.09M]

06-trade evaluation(1).mp4 [75.31M]

07-trade evaluation(2).mp4 [80.89M]

08-trade governance.mp4 [27.57M]

09-review.mp4 [26.57M]

10-practice.mp4 [27.85M]

11-practice again.mp4 [37.79M]

12-practice again and again.mp4 [31.11M]

13-portfolio performance evaluation:introduction.mp4 [11.72M]

14-basis of performance attribution.mp4 [27.67M]

15-brinson model.mp4 [84.93M]

16-macro & micro attribution.mp4 [46.96M]

17-factor based attribution.mp4 [75.94M]

18-another classification.mp4 [38.78M]

19-fixed-income attribution(1).mp4 [64.89M]

20-fixed-income attribution(2).mp4 [18.78M]

21-fixed-income attribution(3).mp4 [17.96M]

22-risk attribution.mp4 [15.92M]

23-benchmarking investments(1).mp4 [63.45M]

24-benchmarking investments(2).mp4 [80.86M]

25-performance appraisal.mp4 [116.45M]

26-review.mp4 [70.13M]

27-practice.mp4 [17.01M]

28-investment manager selection:introduction.mp4 [30.26M]

29-framework for manager selection.mp4 [39.74M]

30-quantitative elements of manager search & selection.mp4 [42.99M]

31-qualitative elements of manager due diligence.mp4 [79.11M]

32-review.mp4 [16.55M]

33-practice.mp4 [11.70M]

34-review of the whole reading.mp4 [29.96M]

l3-精讲交易-wen.pdf [21.53M]

07-另类投资组合管理 [5.51G]

lei [3.78G]

01-brief introduction.mp4 [66.60M]

02-brief introduction for this reading.mp4 [59.58M]

03-introduction and classification.mp4 [152.20M]

04-long/short equity.mp4 [147.37M]

05-dedicated short selling and short-biased(1).mp4 [104.04M]

06-dedicated short selling and short-biased(2).mp4 [92.15M]

07-equity market neutral.mp4 [103.89M]

08-merger arbitrage.mp4 [113.95M]

09-distressed securities.mp4 [65.84M]

10-fixed-income arbitrage (1).mp4 [166.40M]

11-fixed-income arbitrage (2).mp4 [130.49M]

12-convertible bond arbitrage(1).mp4 [108.87M]

13-convertible bond arbitrage(2).mp4 [73.64M]

14-global macro stratege.mp4 [80.13M]

15-managed futures.mp4 [84.31M]

16-volatility trading.mp4 [110.16M]

17-reinsurance/life settlements.mp4 [42.75M]

18-fund-of-funds.mp4 [56.04M]

19-multi-strategy hedge funds(1).mp4 [54.32M]

20-multi-strategy hedge funds(2).mp4 [107.81M]

21-analysis(1).mp4 [117.07M]

22-analysis(2).mp4 [153.91M]

23-portfolio construction.mp4 [72.32M]

24-summary for this reading.mp4 [107.55M]

25-brief introduction of this reading.mp4 [32.63M]

26-the role of alternative investment in a multi-asset portfolio.mp4 [85.43M]

27-diversifying equity risk.mp4 [92.32M]

28-perspectives on the investment opportunity set 1.mp4 [101.61M]

29-perspectives on the investment opportunity set 2.mp4 [95.18M]

30-investment considerations relevant to the decision to invest in alternatives.mp4 [160.11M]

31-suitability considerations.mp4 [55.74M]

32-statistical properties and challenges of asset returns.mp4 [77.57M]

33-monte carlo simulation.mp4 [132.98M]

34-portfolio optimization.mp4 [123.18M]

35-risk factor-based optimization.mp4 [63.45M]

36-liquidity planning.mp4 [100.05M]

37-monitoring the investment program.mp4 [65.82M]

38-summary for the this reading.mp4 [145.02M]

39-summary for the whole reading.mp4 [133.37M]

l3-精讲另类-lei.pdf [32.14M]

l3-精讲另类思维导图-lei.zip [206.54K]

veroniaca [1.73G]

01-introduction.mp4 [37.74M]

02-classification of hedge funds and strategies.mp4 [47.02M]

03-equity-related hedge fund strategies.mp4 [152.77M]

04-event-driven hedge fund strategies.mp4 [129.71M]

05-relative value.mp4 [195.36M]

06-opportunistic strategies.mp4 [121.82M]

07-specialist strategies.mp4 [103.16M]

08-multi-manager strategies.mp4 [85.53M]

09-conditional factor risk model.mp4 [89.24M]

10-hedge fund strategies summary.mp4 [69.31M]

11-roles of alternative investments.mp4 [64.58M]

12-investment opportunity set.mp4 [96.19M]

13-suitability considerations.mp4 [47.62M]

14-assest allocation approaches.mp4 [170.00M]

15-liquidity planning and monitor.mp4 [74.03M]

16-summary.mp4 [57.76M]

17-hedge fund strategy example.mp4 [207.09M]

l3-精讲另类-veroniaca.pdf [20.77M]

08-固定收益组合管理 [8.18G]

chen [6.34G]

01-introduction.mp4 [13.44M]

02-roles in portfolio management and fixed-income mandates.mp4 [137.21M]

03-review for measures of risk and return.mp4 [88.09M]

04-considerations for liquidity and taxation.mp4 [55.17M]

05-decomposing expected returns.mp4 [179.65M]

06-leverage analysis.mp4 [119.52M]

07-summary.mp4 [20.98M]

08-introduction for reading 2.mp4 [16.69M]

09-liability management.mp4 [71.71M]

10-basic ideas about immunization.mp4 [120.76M]

11-macaulay duration.mp4 [96.78M]

12-convexity and structural risk.mp4 [197.90M]

13-cash flow matching & laddered portfolios.mp4 [152.28M]

14-duration matching.mp4 [139.89M]

15-derivative overlay strategies.mp4 [175.86M]

16-an example.mp4 [196.57M]

17-contingent immunization.mp4 [104.43M]

18-risks in liability-driven investing.mp4 [56.13M]

19-features of bond indexes.mp4 [86.87M]

20-benchmark selecting.mp4 [86.29M]

21-full replication and enhanced indexing.mp4 [206.52M]

22-alternatives to investing directly.mp4 [74.85M]

23-summary for reading 2.mp4 [94.24M]

24-introduction of reading 3.mp4 [17.79M]

25-key concepts for active management.mp4 [119.89M]

26-cash-based static yield curve strategies.mp4 [200.05M]

27-derivative-based static yield curve strategies.mp4 [157.63M]

28-strategies for divergent view(1).mp4 [163.08M]

29-strategies for divergent view(2).mp4 [168.70M]

30-yield curve volatility strategies.mp4 [171.58M]

31-key rate duration for a portfolio.mp4 [68.51M]

32-active management across currencies.mp4 [125.40M]

33-a framework for evaluating yield curve strategies.mp4 [75.75M]

34-1-summary for reading 3.mp4 [54.86M]

34-2-introduction for reading 4.mp4 [23.30M]

35-credit risk considerations.mp4 [183.67M]

36-fixed-rate bond credit spread measures(1).mp4 [170.27M]

37-fixed-rate bond credit spread measures(2).mp4 [157.44M]

38-floating-rate note credit spread measures.mp4 [170.70M]

39-empirical duration and spread duration.mp4 [210.29M]

40-excess spread.mp4 [158.13M]

41-bottom-up credit strategie.mp4 [128.06M]

42-top-down credit strategies.mp4 [70.21M]

43-synthetic credit strategies(1).mp4 [187.36M]

44-synthetic credit strategies(2).mp4 [170.50M]

45-static credit spread curve strategies.mp4 [358.95M]

46-dynamic credit spread curve strategies.mp4 [106.49M]

47-global credit strategies.mp4 [54.47M]

48-structured credit.mp4 [72.52M]

49-liquidity risk and tail risk.mp4 [111.87M]

50-fixed-income analytics.mp4 [27.44M]

51-summary for reading 4.mp4 [120.55M]

52-general summary.mp4 [57.13M]

l3-精讲固收-chen(上).pdf [79.32M]

l3-精讲固收-chen(下).pdf [58.87M]

john [1.84G]

01-brief introduction.mp4 [17.10M]

02-introduction overview of fixed-income portfolio management.mp4 [6.08M]

03-roles.mp4 [20.68M]

04-mandates.mp4 [96.37M]

05-return analysis.mp4 [26.64M]

06-other consideration.mp4 [52.26M]

07-review overview of fixed-income portfolio management.mp4 [12.47M]

08-introduction liability-driven and index-based strategies.mp4 [14.09M]

09-liability-driven strategies.mp4 [29.69M]

10-single liability managing strategy(1).mp4 [71.06M]

11-single liability managing strategy(2).mp4 [34.63M]

12-multiple liabilities managing strategy.mp4 [64.82M]

13-multiple liabilities managing strategy:derivatives overlay (1).mp4 [93.09M]

14-multiple liabilities managing strategy:derivatives overlay (2).mp4 [48.11M]

15-multiple liabilities managing strategy:contingent immunization.mp4 [47.22M]

16-passive investing.mp4 [63.40M]

17-alternative methods of passive investing.mp4 [48.48M]

18-benchmark choosing.mp4 [48.08M]

19-review liability-driven and index-based strategies.mp4 [21.44M]

20-introduction yield curve strategies.mp4 [6.22M]

21-static yield curve.mp4 [37.67M]

22-dynamic yield curve level and slope.mp4 [80.42M]

23-dynamic yield curve curvature and interest rate volatility.mp4 [84.34M]

24-yield curve dynamics management key rate duration.mp4 [31.54M]

25-management across currencies.mp4 [54.44M]

26-evaluating expected return and risk.mp4 [23.86M]

27-review yield curve strategies.mp4 [19.66M]

28-introduction fixed-income active managementcredit strategies.mp4 [6.45M]

29-basic concepts of credit risk.mp4 [68.94M]

30-credit spread measure fixed-rate bonds.mp4 [107.63M]

31-credit spread measure floating-rate bonds.mp4 [27.67M]

32-return calculation.mp4 [38.54M]

33-liquidity risk and tail risk.mp4 [48.23M]

34-bottom-up approach.mp4 [78.56M]

35-top-down approach.mp4 [48.62M]

36-credit strategies cds and credit spread curve.mp4 [58.98M]

37-credit strategies global credit and structured instruments.mp4 [50.82M]

38-fixed – income analytics.mp4 [12.54M]

39-review credit strategies.mp4 [23.04M]

40-general review of fixed income portfolio management.mp4 [55.02M]

41-duration(补充).mp4 [78.44M]

42-convexity(补充).mp4 [25.78M]

09-私人财富管理 [5.34G]

chen [5.34G]

01-introduction.mp4 [45.35M]

02-private client versus institutional clients.mp4 [119.14M]

03-information and skills needed in advising private clients.mp4 [133.38M]

04-private client goals.mp4 [157.44M]

05-private client risk tolerance.mp4 [127.92M]

06-retirement planning & private client segments.mp4 [119.81M]

07-investment policy statement.mp4 [116.77M]

08-investment planning and capital sufficiency analysis.mp4 [96.88M]

09-portfolio construction.mp4 [61.10M]

10-portfolio reporting and review & evaluating the success ethical consideration.mp4 [98.24M]

11-practices for essay question.mp4 [279.35M]

12-summary for reading 1.mp4 [43.20M]

13-introduction.mp4 [34.09M]

14-brief introduction of taxation considerations.mp4 [103.00M]

15-tax efficiency.mp4 [242.27M]

16-tax status of account.mp4 [215.83M]

17-investment vehicles.mp4 [201.50M]

18-tax lot accounting.mp4 [168.83M]

19-practices for essay questions.mp4 [134.53M]

20-risk and tax considerations in managing concentrated single-asset positions.mp4 [89.47M]

21-strategies for managing concentrated positions in public equities(1).mp4 [108.14M]

22-risk and tax considerations in managing concentrated single-asset positions (2).mp4 [177.27M]

23-strategies for managing concentrated positions in privately owned businesses.mp4 [136.57M]

24-practices for essay questions.mp4 [129.86M]

25-objectives of gift and estate planning.mp4 [68.64M]

26-basic concepts of gift and estate planning.mp4 [152.09M]

27-lifetime gifts and testamentary bequests.mp4 [129.04M]

28-efficiency of lifetime gifts versus testamentary bequests.mp4 [165.82M]

29-estate planning tools.mp4 [126.03M]

30-practices for essay question.mp4 [83.06M]

31-family governance.mp4 [66.06M]

32-summary for reading 2.mp4 [58.95M]

33-introduction.mp4 [18.41M]

34-definition and characteristics of human capital and financial capital.mp4 [139.99M]

35-implementation of risk management for individuals.mp4 [96.89M]

36-individuals risk exposures.mp4 [77.87M]

37-life insurance.mp4 [137.94M]

38-analyze and evaluate of life insurance.mp4 [243.80M]

39-annuities.mp4 [132.62M]

40-practices for essay questions.mp4 [88.04M]

41-summary for reading 3.mp4 [26.50M]

42-case study for private wealth management(1).mp4 [178.51M]

43-case study for private wealth management(2).mp4 [67.85M]

44-case study for private wealth management(3).mp4 [81.05M]

45-case study for private wealth management(4).mp4 [50.15M]

46-general summary.mp4 [26.26M]

l3-精讲个人ips-chen(上).pdf [81.82M]

l3-精讲个人ips-chen(下).pdf [33.29M]

10-机构投资者组合管理 [2.41G]

wen [954.56M]

01-brief introduction.mp4 [10.60M]

02-overview.mp4 [74.93M]

03-pension fund.mp4 [139.10M]

04-practice.mp4 [22.56M]

05-practice again.mp4 [16.56M]

06-sovereign wealth funds.mp4 [74.47M]

07-swf-practice.mp4 [12.57M]

08-endowment and foundation.mp4 [75.74M]

09-endowment and foundation – practice.mp4 [76.70M]

10-bank and insurers:boring part.mp4 [57.23M]

11-bank and insurers:important part.mp4 [125.54M]

12-bank and insurers:practice.mp4 [12.46M]

13-case study liquidity management.mp4 [68.67M]

14-case study practice.mp4 [79.93M]

15-case study risk management.mp4 [49.48M]

16-summary.mp4 [51.64M]

l3-精讲机构ips -wen.pdf [6.37M]

zion [1.47G]

01-introduction.mp4 [21.54M]

02-common characteristics of institutional investors.mp4 [99.84M]

03-pension plans(1).mp4 [65.02M]

04-pension plans(2).mp4 [198.49M]

05-sovereign wealth funds.mp4 [176.06M]

06-university endowments.mp4 [170.09M]

07-private foundations.mp4 [126.28M]

08-banks&insurers.mp4 [113.78M]

09-balance sheet management.mp4 [163.58M]

10-case study in portfolio managementinstitutional(1).mp4 [189.27M]

11-case study in portfolio managementinstitutional(2).mp4 [166.70M]

l3-精讲机构ips-zion.pdf [18.77M]

11-伦理与职业标准 [2.05G]

01-introduction.mp4 [34.42M]

02-code of ethics and standards of professional conduct.mp4 [42.37M]

03-guidance for standards ⅰ-ⅲ (1).mp4 [104.24M]

04-guidance for standards ⅰ-ⅲ (2).mp4 [80.20M]

05-guidance for standards ⅳ-ⅶ(1).mp4 [87.58M]

06-guidance for standards ⅳ-ⅶ(2).mp4 [55.79M]

07-application of the code and standards[1]-a.mp4 [56.26M]

08-application of the code and standards[1]-b.mp4 [109.01M]

09-application of the code and standards[1]-c.mp4 [112.70M]

10-application of the code and standards[2].mp4 [173.95M]

11-asset manager code(1).mp4 [98.58M]

12-asset manager code(2).mp4 [73.55M]

13-asset manager code(3).mp4 [73.51M]

14-overview of gips[1]objective and scope.mp4 [171.56M]

15-overview of gips[2]firm and discretion.mp4 [83.81M]

16-overview of gips[3]return calculation methodologies.mp4 [167.02M]

17-overview of gips[4]composite return calculations.mp4 [51.34M]

18-overview of gips[5]discretion and mandates.mp4 [76.66M]

19-overview of gips[6]composite construction.mp4 [98.15M]

20-overview of gips[7]presentation and reporting.mp4 [221.13M]

21-overview of gips[8]valuation and verification.mp4 [70.31M]

22-summary.mp4 [41.75M]

l3-精讲道德-veronica.pdf [14.51M]

l3-精讲另类思维导图-lei.zip [206.54K]

l3-精讲权益思维导图-lei.zip [668.74K]

l3-精讲衍生思维导图-feng.zip [138.59K]

l3-精讲资产配置思维导图-feng.zip [1.23M]

【2】无忧直播-精讲阶段(5-8月) [3.53G]

讲义 [39.45M]

精讲阶段-道德直播讲义.pdf [9.75M]

精讲阶段-固收直播讲义.pdf [4.78M]

精讲阶段-机构财富管理直播讲义.pdf [1.24M]

精讲阶段-交易直播讲义.pdf [3.56M]

精讲阶段-经济直播讲义.pdf [529.10K]

精讲阶段-开班直播讲义.pdf [6.68M]

精讲阶段-另类直播讲义.pdf [710.54K]

精讲阶段-权益直播讲义.pdf [1.57M]

精讲阶段-行为金融直播讲义.pdf [1.07M]

精讲阶段-衍生和汇率管理直播讲义.pdf [4.40M]

精讲阶段-资产配置直播讲义.pdf [5.18M]

00-精讲阶段-开班直播.mp4 [176.80M]

01-精讲阶段-行为金融直播.mp4 [258.60M]

02-精讲阶段-经济直播.mp4 [249.69M]

03-精讲阶段-资产配置直播.mp4 [243.77M]

04-精讲阶段-衍生和汇率管理直播.mp4 [263.08M]

05-精讲阶段-权益直播.mp4 [250.77M]

06-精讲阶段-交易直播.mp4 [258.36M]

07-精讲阶段-另类直播.mp4 [292.80M]

08-精讲阶段-固收直播.mp4 [512.80M]

09-精讲阶段-私人财富管理直播.mp4 [345.29M]

10-精讲阶段-机构财富管理直播.mp4 [518.12M]

11-精讲阶段-道德直播.mp4 [209.73M]

【3】无忧直播-复习阶段(5-8月) [6.21G]

00-复习阶段-开班直播.mp4 [176.35M]

01-复习阶段-行为金融直播.mp4 [248.72M]

02-复习阶段-资产配置直播.mp4 [447.31M]

03-复习阶段-经济直播.mp4 [560.58M]

04-复习阶段-权益直播.mp4 [458.86M]

05-复习阶段-衍生品直播.mp4 [409.62M]

06-复习阶段-交易直播.mp4 [439.23M]

07-复习阶段-另类直播.mp4 [733.62M]

08-复习阶段-固收直播.mp4 [738.20M]

09-复习阶段-个人ips直播.mp4 [758.26M]

10-复习阶段-机构ips直播.mp4 [667.81M]

11-复习阶段–道德直播.mp4 [638.26M]

复习阶段-道德直播讲义.pdf [10.73M]

复习阶段-个人ips直播讲义.pdf [8.44M]

复习阶段-固收直播讲义.pdf [6.20M]

复习阶段-机构ips直播讲义.pdf [7.38M]

复习阶段-经济直播讲义.pdf [8.30M]

复习阶段-开班直播讲义.pdf [5.89M]

复习阶段-权益直播讲义.pdf [8.43M]

复习阶段-行为金融直播讲义.pdf [14.92M]

复习阶段-衍生品直播讲义.pdf [4.67M]

复习阶段-资产配置直播讲义.pdf [10.35M]

【4】复习冲刺(5-8月) [4.94G]

01-行为金融 [123.15M]

01-introduction.mp4 [9.43M]

02-individual biases(1).mp4 [23.58M]

03-individual biases(2).mp4 [41.62M]

04-other issues.mp4 [48.53M]

02-资产配置 [262.10M]

01-brief introduction.mp4 [10.64M]

02-brief introduction.mp4 [91.09M]

03-principles of asset allocation.mp4 [108.31M]

04-asset allocation with real-world constraints.mp4 [52.06M]

03-经济 [492.80M]

01-overview.mp4 [26.10M]

02-framework and challenges.mp4 [53.57M]

03-economic and market analysis(1).mp4 [105.09M]

04-economic and market analysis(2).mp4 [85.91M]

05-economic and market analysis(1).mp4 [51.04M]

06-forecasting the fixed-income and equity returns.mp4 [59.72M]

07-practice 2.mp4 [17.05M]

08-forecasting real estate returns,exchange rates and volatility.mp4 [76.18M]

09-practice 3.mp4 [18.14M]

04-权益组合管理 [968.42M]

01-roles and investment universe.mp4 [58.61M]

02-benefit and cost of equity portfolio investment.mp4 [73.21M]

03-choosing a benchmark.mp4 [113.22M]

04-approaches to passive equity investing.mp4 [103.77M]

05-return and risk in passive equity portfolio.mp4 [65.67M]

06-approaches to active management.mp4 [28.25M]

07-types of active management strategies(1).mp4 [60.30M]

08-types of active management strategies(2).mp4 [111.87M]

09-creating a fundamental & quantitative active investment strategy.mp4 [77.05M]

10-equity investment style classification.mp4 [37.29M]

11-building blocks of active equity portfolio construction & approaches to portfolio construction.mp4 [113.67M]

12-allocating risk.mp4 [60.18M]

13-the well constructed & long/short constructed portfolio.mp4 [65.34M]

05-固定收益组合管理 [808.74M]

01-overview of fixed-income portfolio management.mp4 [145.38M]

02-liability-driven and index-based strategies.mp4 [195.28M]

03-yield curve strategies.mp4 [171.38M]

04-fixed-income active managementcredit strategies(1).mp4 [172.96M]

05-fixed-income active managementcredit strategies(2).mp4 [123.73M]

06-私人财富管理 [716.43M]

01-overview of private wealth management.mp4 [113.80M]

02-topics in private wealth management(1).mp4 [140.59M]

03-topics in private wealth management(2).mp4 [136.59M]

04-topics in private wealth management(3).mp4 [97.38M]

05-risk management for individuals.mp4 [228.06M]

07-交易、业绩评估与经理选择 [408.71M]

01-introduction.mp4 [3.04M]

02-trade strategy and execution(1).mp4 [88.94M]

03-trade strategy and execution(2).mp4 [91.92M]

04-portfolio performance evaluation.mp4 [78.39M]

05-benchmarking investments.mp4 [17.28M]

06-performance appraisal.mp4 [94.59M]

07-investment manager selection.mp4 [34.55M]

08-伦理与职业标准 [426.07M]

01-overview.mp4 [20.82M]

02-asset manager code.mp4 [94.51M]

03-overview of gips (1).mp4 [86.60M]

04-overview of gips (2).mp4 [57.82M]

05-overview of gips (3).mp4 [39.32M]

06-overview of gips (4).mp4 [49.75M]

07-overview of gips (5).mp4 [59.83M]

l3-复习道德-veronica.pdf [17.42M]

09-机构投资者组合管理 [95.77M]

01-introduction.mp4 [2.28M]

02-overview.mp4 [7.43M]

03-pension funds.mp4 [32.91M]

04-sovereign wealth funds.mp4 [18.49M]

05-endowments and foundations.mp4 [22.15M]

06-bank and insurers.mp4 [11.22M]

l3-复习机构ips-wen.pdf [1.29M]

10-另类投资组合管理 [464.79M]

01-overview.mp4 [19.71M]

02-hedge fund strategies(1).mp4 [89.16M]

03-hedge fund strategies(2).mp4 [95.89M]

04-hedge fund strategies(3).mp4 [64.33M]

05-hedge fund strategies(4).mp4 [55.03M]

06-role of alternative investments.mp4 [33.56M]

07-investment opportunity set.mp4 [50.60M]

08-investment considerations.mp4 [31.42M]

09-asset allocation approaches.mp4 [22.50M]

l3-复习另类-veronica.pdf [2.58M]

11-衍生品和货币管理 [215.34M]

01-brief introduction.mp4 [9.88M]

02-option stragety.mp4 [60.61M]

03-swaps,forwards,and futures strategies.mp4 [74.58M]

04-currency management:an introduction.mp4 [60.24M]

l3-复习衍生-feng.pdf [10.04M]

讲义 [74.49M]

l3-复习个人ips-chen.pdf [16.16M]

l3-复习固收-chen.pdf [18.64M]

l3-复习交易-wen.pdf [17.14M]

l3-复习经济-veronica.pdf [4.39M]

l3-复习权益-lei.pdf [6.58M]

l3-复习行为金融-wen.pdf [4.03M]

l3-复习资产配置-feng.pdf [7.55M]

【5】考前冲刺(5月) [835.60M]

个人ips&机构ips-考前冲刺直播.mp4 [255.10M]

个人ips&机构ips-考前冲刺直播讲义.pdf [1.61M]

经济&权益&另类&道德-考前冲刺直播.mp4 [311.09M]

经济&权益&另类&道德-考前冲刺直播讲义.pdf [1.10M]

行为金融&资产配置&交易-考前冲刺直播.mp4 [266.21M]

行为金融&资产配置&交易-考前冲刺直播讲义.pdf [509.40K]

课程下载地址:

精品课程,SVIP会员免费下载,下载前请阅读上方文件目录,链接下载为百度云网盘,如连接失效,可评论告知。

我爱考试网 » 金融:2022年CFA三级【G】 百度网盘(69.27G)