金融:2022年FRM二级【G】 百度网盘(27.08G)

课程文件目录:金融:2022年FRM二级【G】[27.08G]

【1】知识精讲(5-11月) [14.79G]

【1】frm二级课程介绍 [58.44M]

introduction.mp4 [56.70M]

introduction讲义.pdf [1.75M]

【3】市场风险管理与测量 [2.28G]

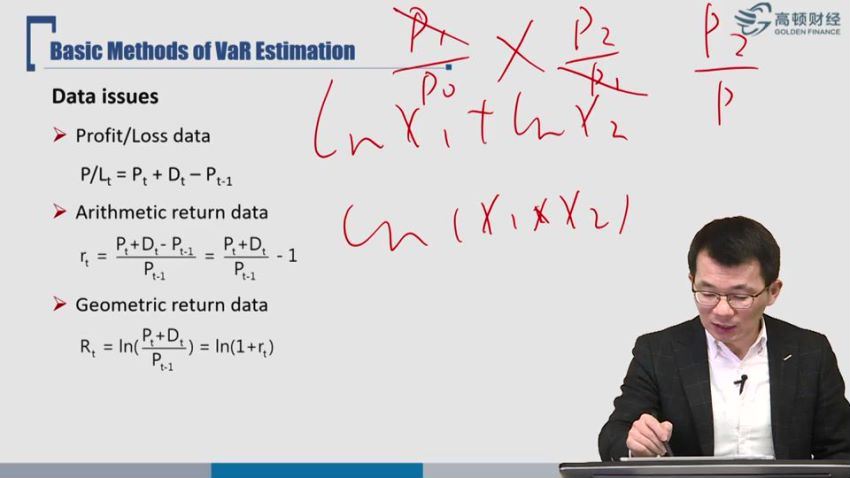

02-basic methods of var estimation.mp4 [115.54M]

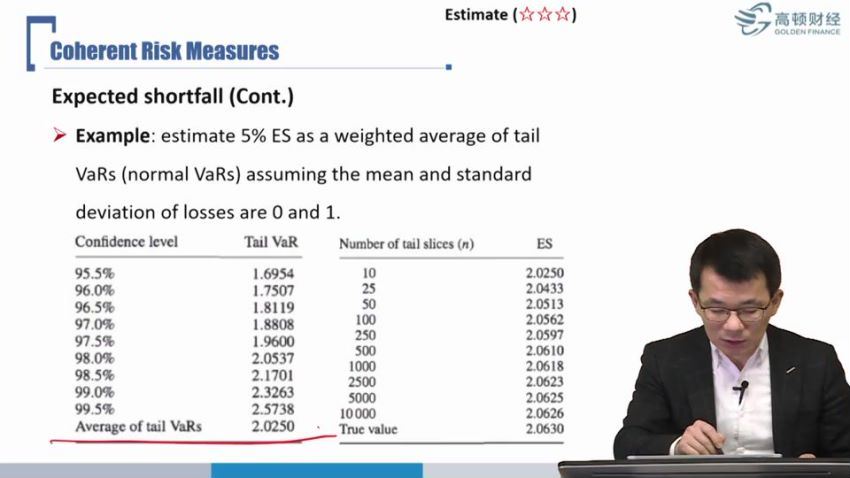

03-coherent risk measures.mp4 [57.81M]

04-historical simulation.mp4 [55.52M]

05-weighted historical simulation.mp4 [105.99M]

06-gev generalized extreme-value theory.mp4 [61.52M]

07-pot peaks-over-threshold approach.mp4 [83.06M]

08-backtesting var (1).mp4 [105.46M]

09-backtesting var (2).mp4 [119.04M]

10-var mapping.mp4 [214.14M]

11-some correlation basics(1).mp4 [140.07M]

12-some correlation basics (2).mp4 [115.08M]

13-empirical properties of correlation.mp4 [57.56M]

14-financial correlation modeling.mp4 [76.58M]

15-binomial interest rate tree model.mp4 [126.29M]

16-issues with interest rate tree model.mp4 [49.68M]

17-the shape of the term structure.mp4 [88.95M]

18-the art of term structure models drift (1).mp4 [117.58M]

19-the art of term structure models drift (2).mp4 [75.64M]

20-volatility and distribution.mp4 [102.98M]

21-messages from the academic literature on risk measurement for the trading book.mp4 [74.09M]

22-fundamantal review of trading book.mp4 [101.60M]

23-empirical approaches to risk metrics and hedges.mp4 [61.63M]

24-volatility smiles.mp4 [183.99M]

introduction.mp4 [49.00M]

【4】流动性与资金风险测量与管理 [3.07G]

session 1 introduction of liquidity risk management [512.29M]

1-introduction of liquidity and treasury risk measurement.mp4 [56.46M]

2-liquidity and leverage(1).mp4 [310.33M]

3-liquidity and leverage(2).mp4 [145.50M]

session 2 framework of liquidity risk management [915.86M]

1-liquidity stress testing.mp4 [105.69M]

2-liquidity risk reporting and stress testing.mp4 [74.87M]

3-intraday liquidity risk management.mp4 [152.80M]

4-monitoring liquidity.mp4 [271.77M]

5-early warning indicators.mp4 [169.82M]

6-contingency funding planning.mp4 [140.93M]

session 3 management of liquidity investment [901.50M]

09-the investment function in financial services management.mp4 [259.39M]

10-repurchase agreements and financing(1).mp4 [133.83M]

11-repurchase agreements and financing(2).mp4 [196.38M]

12-illiquid assets.mp4 [311.90M]

session 4 modelling liquidity risk management [607.76M]

1-liquidity and reserves management strategies and polices.mp4 [297.78M]

2-managing and pricing deposit services.mp4 [111.51M]

3-managing non-deposit liabilities.mp4 [92.46M]

4-risk management for changing interest rate.mp4 [106.01M]

session 5 other liquidity issues [210.29M]

1-liquidity transfer pricing.mp4 [66.19M]

2-the failure of dealer bank.mp4 [37.52M]

3-covered interest rate parity lost.mp4 [76.61M]

4-the shortage of us dollar.mp4 [29.97M]

【5】投资管理与风险管理 [2.14G]

01-introduction.mp4 [32.27M]

02-factor theory and capm (1).mp4 [81.71M]

03-factor theory and capm (2).mp4 [45.24M]

04-multifactor and emh.mp4 [66.08M]

05-macro factors.mp4 [90.94M]

06-dynamic factors.mp4 [119.01M]

07-active management.mp4 [61.11M]

08-benchmarker matters.mp4 [133.33M]

09-inputs for portfolio construction(1).mp4 [122.36M]

10-inputs for portfolio construction(2).mp4 [62.01M]

11-portfolio construction techniques.mp4 [68.94M]

12-portfolio var measures.mp4 [146.51M]

13-using var for risk management.mp4 [66.80M]

14-specific risks in investment management(1).mp4 [69.03M]

15-specific risks in investment management(2).mp4 [58.31M]

16-risk budgeting(1).mp4 [45.76M]

17-risk budgeting(2).mp4 [69.44M]

18-three-legged risk management stool.mp4 [26.64M]

19-rmus&performance measurement.mp4 [34.98M]

20-conventional theory(1).mp4 [105.54M]

21-conventional theory(2).mp4 [66.07M]

22-market timing.mp4 [58.54M]

23-performance attribution.mp4 [82.13M]

24-characteristics of hedge funds.mp4 [96.00M]

25-hedge funds strategies(1).mp4 [63.36M]

26-hedge funds strategies(1).mp4 [95.91M]

27-risks in hedge funds.mp4 [32.62M]

28-performing due diligence on specific managers and funds.mp4 [97.10M]

29-finding bernie madoff detecting fraud by investment managers.mp4 [94.50M]

【6】操作风险与综合风险 [5.72G]

01-introduction.mp4 [73.85M]

02-principles for the sound management of operational risk(1).mp4 [141.62M]

03-principles for the sound management of operational risk(2).mp4 [95.35M]

04-principles for the sound management of operational risk(3).mp4 [128.40M]

05-principles for the sound management of operational risk(4).mp4 [115.37M]

06-banking conduct and culture(1).mp4 [134.12M]

07-banking conduct and culture(2).mp4 [72.61M]

08-risk culture.mp4 [135.03M]

09-what is erm(1).mp4 [105.98M]

10-what is erm(2).mp4 [43.67M]

11-enterprise risk management theory and practice.mp4 [115.64M]

12-risk appetite and it’s key findings.mp4 [147.22M]

13-practices to overcome challenges.mp4 [87.31M]

14-recommendations.mp4 [54.13M]

15-op risk data and governance(1).mp4 [161.36M]

16-op risk data and governance(2).mp4 [149.37M]

17-op risk data and governance(3).mp4 [46.62M]

18-information risk and data quality management.mp4 [140.37M]

19-supervisory guidance on model risk management(1).mp4 [67.28M]

20-supervisory guidance on model risk management(2).mp4 [81.91M]

21-validating rating models (1).mp4 [70.96M]

22-validating rating models (2).mp4 [63.35M]

23-assessing the quality of risk measures(1).mp4 [123.34M]

24-assessing the quality of risk measures(2).mp4 [72.43M]

25-risk capital attribution & risk-adjusted performance(1).mp4 [89.26M]

26-risk capital attribution & risk-adjusted performance(2).mp4 [88.32M]

27-risk capital attribution & risk-adjusted performance(3).mp4 [120.44M]

28-range of practices and issues in economic capital frameworks(1).mp4 [143.44M]

29-range of practices and issues in economic capital frameworks(2).mp4 [99.31M]

30-capital planning at large bank holding companies.mp4 [87.64M]

31-stress testing banks.mp4 [120.18M]

32-regulation of the otc derivatives market(1).mp4 [80.52M]

33-regulation of the otc derivatives market(2).mp4 [84.10M]

34-basel i.mp4 [142.38M]

35-basel i amendments.mp4 [177.54M]

36-basel ii – three pillars and credit risk(1).mp4 [76.54M]

37-basel ii – three pillars and credit risk(2).mp4 [122.61M]

38-basel ii – operational risk.mp4 [95.12M]

39-basel ii – solvency ii.mp4 [34.98M]

40-basel ii.5.mp4 [91.05M]

41-basel iii-capital requirements (1).mp4 [86.81M]

42-basel iii-capital requirements (2).mp4 [69.57M]

43-basel iii-capital requirements (3).mp4 [105.83M]

44-basel iii-liquidity risk & cva.mp4 [142.85M]

45-high-level summary of basel ill reforms(1).mp4 [127.01M]

46-high-level summary of basel ill reforms(2).mp4 [67.23M]

47-basel ill finalizing post-crisis reforms(1).mp4 [118.12M]

48-basel ill finalizing post-crisis reforms(2).mp4 [85.88M]

49-supplementary(frtb).mp4 [144.25M]

50-guidance on managing outsourcing risk.mp4 [131.82M]

51-management of risks associated with money laundering and financing of terrorism.mp4 [49.58M]

52-the cyber-resilient organization(1).mp4 [132.71M]

53-the cyber-resilient organization(2).mp4 [79.56M]

54-cyber-resilience range of practices(1).mp4 [103.55M]

55-cyber-resilience range of practices(2).mp4 [61.94M]

56-cyber-resilience range of practices(3).mp4 [94.15M]

57-operational resilience impact tolerance for important business services.mp4 [86.98M]

58-principles for operational resilience.mp4 [60.88M]

59-striving for operational resilience.mp4 [31.13M]

【7】current issues in financial markets [1.08G]

01-introduction to ai & ml.mp4 [38.79M]

02-ai & ml for risk management.mp4 [179.09M]

03-ai risk & governance.mp4 [97.18M]

04-covid-19 and cyber risk in the financial sector.mp4 [143.46M]

05-holistic review of the march market turmoil.mp4 [226.70M]

06-climate related risk drives and their transimission channels.mp4 [197.82M]

07-amplifiers and mitigants.mp4 [78.11M]

08-the rise of digital money.mp4 [143.54M]

讲义 [445.09M]

2022 p2网课 操作风险与综合风险(1) 2022.pdf [68.52M]

2022 p2网课 操作风险与综合风险(2) 2022.pdf [61.20M]

frm p2时事 climate-related risk & digital money.pdf [16.72M]

frm p2时事 ai, ml & big data.pdf [8.68M]

frm p2时事 covid-19 and cyber risk in the financial sector.pdf [3.96M]

frm p2时事 holistic review of the march market turmoil.pdf [9.45M]

frm p2网课 流动性与资金风险测量与管理 2022.pdf [27.63M]

frm p2网课 市场风险管理与测量 2022.pdf [59.04M]

frm p2网课 投资管理与风险管理 2022.pdf [69.00M]

frm p2网课 信用风险管理与测量(1) 2022.pdf [58.77M]

frm p2网课 信用风险管理与测量(2) 2022.pdf [62.12M]

【2】知识精讲答疑直播(5-11月) [1.14G]

01-投资管理与风险管理直播答疑.mp4 [208.23M]

02-市场风险测量与管理直播答疑.mp4 [175.54M]

操作风险与综合风险答疑直播.mp4 [251.39M]

操作风险与综合风险答疑直播讲义.pdf [24.32M]

流动性与资金风险测量答疑直播.mp4 [276.24M]

流动性与资金风险测量答疑直播讲义.pdf [6.68M]

市场风险管理与测量答疑直播讲义.pdf [4.95M]

投资管理与风险管理直播答疑讲义.pdf [4.96M]

信用风险管理与测量答疑直播.mp4 [212.53M]

信用风险管理与测量答疑直播讲义.pdf [3.89M]

【3】复习阶段(5-11月) [4.46G]

01-市场风险测量与管理 [827.55M]

01-课程介绍.mp4 [15.15M]

02-an introduction and overview.mp4 [54.41M]

03-non-parametric approaches.mp4 [42.30M]

04-parametric approaches:extreme value.mp4 [70.08M]

05-backtesting var.mp4 [69.07M]

06-var mapping.mp4 [75.74M]

07-correlation basics definitions, applications, and terminology.mp4 [43.74M]

08-empirical properties of correlation how do correlations behave in the real world.mp4 [26.99M]

09-financial correlation modeling bottom-up approaches.mp4 [33.37M]

10-the science of term structure models.mp4 [115.12M]

11-the evolution of short rates and the shape of the term structure.mp4 [75.42M]

12-the art of term structure models:drift.mp4 [39.92M]

13-the art of term structure models:volatility and distribution.mp4 [30.55M]

14-other related topics (1).mp4 [73.18M]

15-other related topics (2).mp4 [38.89M]

frm p2市场风险-复习串讲(david zhu).pdf [23.61M]

02-信用风险测量与管理 [1.09G]

01-课程介绍.mp4 [31.93M]

02-identification of credit risk.mp4 [61.62M]

03-rating assignment methodologies.mp4 [66.19M]

04-infer credit risk from equity prices (1).mp4 [71.94M]

05-infer credit risk from equity prices (2).mp4 [39.91M]

06-default intensity models.mp4 [42.38M]

07-credit scoring model.mp4 [38.54M]

08-other methods to estimate pd.mp4 [56.56M]

09-credit exposure.mp4 [62.12M]

10-portfolio credit var.mp4 [66.76M]

11-capital for credit risk.mp4 [64.76M]

12-counterparty risk and wrong-way risk.mp4 [56.52M]

13-netting, close-out and margin (1).mp4 [37.51M]

14-netting, close-out and margin (2).mp4 [47.07M]

15-cva (1).mp4 [55.62M]

16-cva (2).mp4 [75.20M]

17-credit derivatives.mp4 [78.27M]

18-securitization and structured financial instruments (1).mp4 [74.94M]

19-securitization and structured financial instruments (2).mp4 [58.06M]

20-frictions of securitization.mp4 [25.45M]

03-流动性风险 [601.24M]

01-introduction.mp4 [11.62M]

02-liquidity risk.mp4 [36.01M]

03-liquidity and leverge.mp4 [38.56M]

04-liquidity transfer pricing.mp4 [32.16M]

05-the failure of dealer banks.mp4 [13.15M]

06-covered interest rate parity lost.mp4 [32.69M]

07-the us dollar shortage in global banking.mp4 [12.47M]

08-the investment function in financial-services management.mp4 [46.44M]

09-repurchase agreements and financing.mp4 [44.05M]

10-llliquid assets.mp4 [42.29M]

11-liquidity and reserves management.mp4 [49.11M]

12-managing and pricing deposit services.mp4 [29.40M]

13-managing nondeposit liabilities.mp4 [25.79M]

14-risk management for changing interest rate.mp4 [50.23M]

15-liquidity stress testing.mp4 [34.53M]

16-liquidity risk reporting and stress testing.mp4 [23.30M]

17-intraday liquidity risk management.mp4 [21.36M]

18-monitoring liquidity.mp4 [22.40M]

19-early warning indicators.mp4 [16.89M]

20-contingency funding planning.mp4 [18.81M]

04-投资管理与风险管理 [710.57M]

01-课程介绍.mp4 [27.54M]

02-factor theory.mp4 [76.88M]

03-factors.mp4 [42.34M]

04-alpha (and the low-risk anomaly).mp4 [94.89M]

05-portfolio construction.mp4 [101.77M]

06-portfolio risk :analytical methods.mp4 [92.42M]

07-var and risk budgeting in investment management.mp4 [78.69M]

08-var and risk budgeting in investment management.mp4 [17.56M]

09-portfolio performance evaluation.mp4 [81.48M]

10-hedge funds.mp4 [83.76M]

11-performing due diligence on specific managers and funds.mp4 [13.24M]

05-操作与综合风险-复习串讲 [1.11G]

01-introduction.mp4 [14.98M]

02-risk management framework(1).mp4 [107.05M]

03-risk management framework(2).mp4 [47.17M]

04-risk management framework(3).mp4 [56.33M]

05-risk management framework(4).mp4 [34.38M]

06-oprisk data and governance.mp4 [49.61M]

07-information risk and data quality management.mp4 [17.44M]

08-models.mp4 [46.08M]

09-risk capital attribution & risk-adjusted performance.mp4 [51.70M]

10-stress testing banks.mp4 [22.38M]

11-basel accords-regulation of the otc derivative market.mp4 [44.89M]

12-basel accords-basel i.mp4 [38.25M]

13-basel accords-basel i amendments.mp4 [55.65M]

14-basel accords-basel ii.mp4 [137.89M]

15-basel accords-basel ii.5.mp4 [42.70M]

16-basel accords-basel iii.mp4 [128.50M]

17-basel accords-basel iii reform.mp4 [93.01M]

18-basel accords-frtb.mp4 [75.08M]

19-outsourcing risk, ml and ft.mp4 [16.48M]

20-cyber risk and cyber resilience.mp4 [42.45M]

21-operational resilience and impact tolerance.mp4 [13.79M]

frm p2b3 操作风险 复习串讲(leo) .pdf [38.63M]

frm p2流动性风险-复习串讲(gong).pdf [79.94M]

frm p2投资风险-复习串讲(gloria).pdf [26.03M]

frm p2信用-复习串讲(gloria).pdf [34.43M]

【4】百题集训(5-11月) [2.70G]

操作风险和综合风险-答疑直播(辅助知识点).pdf [6.86M]

操作风险和综合风险-答疑直播(讲义).pdf [9.51M]

操作风险与综合风险-答疑直播.mp4 [800.92M]

风险管理与投资管理-答疑直播(讲义).pdf [9.09M]

风险管理与投资管理-答疑直播.mp4 [198.35M]

流动性风险-答疑直播(补充讲义).pdf [1.22M]

流动性风险-答疑直播(讲义).pdf [589.71K]

流动性风险-答疑直播.mp4 [623.55M]

市场风险测量与管理-答疑直播(带解析版本补充讲义).pdf [4.90M]

市场风险测量与管理-答疑直播(讲义).pdf [4.58M]

市场风险测量与管理-答疑直播.mp4 [241.29M]

信用风险测量与管理-答疑直播(讲义).pdf [12.76M]

信用风险测量与管理答疑直播.mp4 [847.30M]

【5】重难点直播(5-11月) [1.02G]

p2b1和p2b5百题集训题目对比(补充讲义).pdf [1.29M]

操作与综合风险 强化题答疑讲义.pdf [11.79M]

操作与综合风险 强化题答疑直播.mp4 [218.52M]

风险管理与投资管理 强化题答疑(讲义).pdf [9.12M]

风险管理与投资管理 强化题答疑直播.mp4 [204.36M]

流动性风险 强化题答疑直播.mp4 [206.28M]

流动性风险-复习强化题答疑(讲义).pdf [9.82M]

市场风险-重难点答疑直播(讲义).pdf [5.10M]

市场风险—重难点答疑直播.mp4 [177.73M]

信用风险 重难点答疑(讲义).pdf [10.55M]

信用风险—重难点答疑直播.mp4 [188.86M]

【6】强化题解析(5-11月) [714.52M]

风险管理和投资管理 [295.53M]

风险管理和投资管理1-15.mp4 [114.85M]

风险管理和投资管理16-30.mp4 [114.12M]

风险管理和投资管理31-43.mp4 [66.56M]

市场风险 [205.93M]

市场风险强化题解析1.mp4 [43.67M]

市场风险强化题解析2.mp4 [43.70M]

市场风险强化题解析3.mp4 [53.64M]

市场风险强化题解析4.mp4 [35.00M]

市场风险强化题解析5.mp4 [29.92M]

信用风险 [213.06M]

信用风险强化题解析1.mp4 [62.48M]

信用风险强化题解析2.mp4 [41.10M]

信用风险强化题解析3.mp4 [50.97M]

信用风险强化题解析4.mp4 [58.51M]

【7】模考班(5月) [2.27G]

a [1.11G]

mock a 市场风险答疑(讲义).pdf [7.33M]

mock a 信用风险答疑(讲义).pdf [489.41K]

mock exam a – 风险管理和投资管理 答疑直播.mp4 [144.99M]

mock exam a- 风险管理与投资管理(讲义).pdf [7.27M]

mock exam a 信用风险答疑直播.mp4 [186.69M]

操作风险 mock a 答疑讲义.pdf [8.91M]

操作风险 mock a 答疑直播.mp4 [201.73M]

流动性风险 mock a 答疑(讲义).pdf [425.86K]

流动性风险 mock exam a 答疑直播.mp4 [201.40M]

市场风险- mock exam a 答疑直播.mp4 [377.27M]

b [1.16G]

mock b 市场风险答疑(讲义).pdf [7.57M]

mock b 信用风险答疑(讲义).pdf [7.30M]

mock exam b – 风险管理与投资管理 答疑讲义.pdf [7.72M]

mock exam b – 风险管理与投资管理 答疑直播.mp4 [152.77M]

mock exam b – 流动性风险 答疑直播.mp4 [339.00M]

mock exam b 市场风险答疑直播.mp4 [151.56M]

mock exam b 信用风险答疑直播.mp4 [181.77M]

操作风险 mock exam b 答疑讲义.pdf [7.33M]

操作风险 mock exam b 答疑直播.mp4 [336.08M]

流动性风险 mock b 答疑讲义.pdf [380.66K]

课程下载地址:

精品课程,SVIP会员免费下载,下载前请阅读上方文件目录,链接下载为百度云网盘,如连接失效,可评论告知。

我爱考试网 » 金融:2022年FRM二级【G】 百度网盘(27.08G)